tennessee inheritance tax laws

This is a type of inheritance law where each spouse automatically owns. How to avoid probate in Tennessee.

Do You Need A Tax Id Number When The Trust Grantor Dies Probate When Someone Dies Last Will And Testament

Tennessee Inheritance and Gift Tax.

. Tennessee Inheritance Tax Disappears in 2016. In 2014 the Tennessee Inheritance Tax exemption was set at 2 million. If the value of the gross estate is below the exemption allowed for the year of death.

All inheritance are exempt in the State of Tennessee. However it applies only to the estate physically located and transferred within the state between. The maximum Tennessee estate.

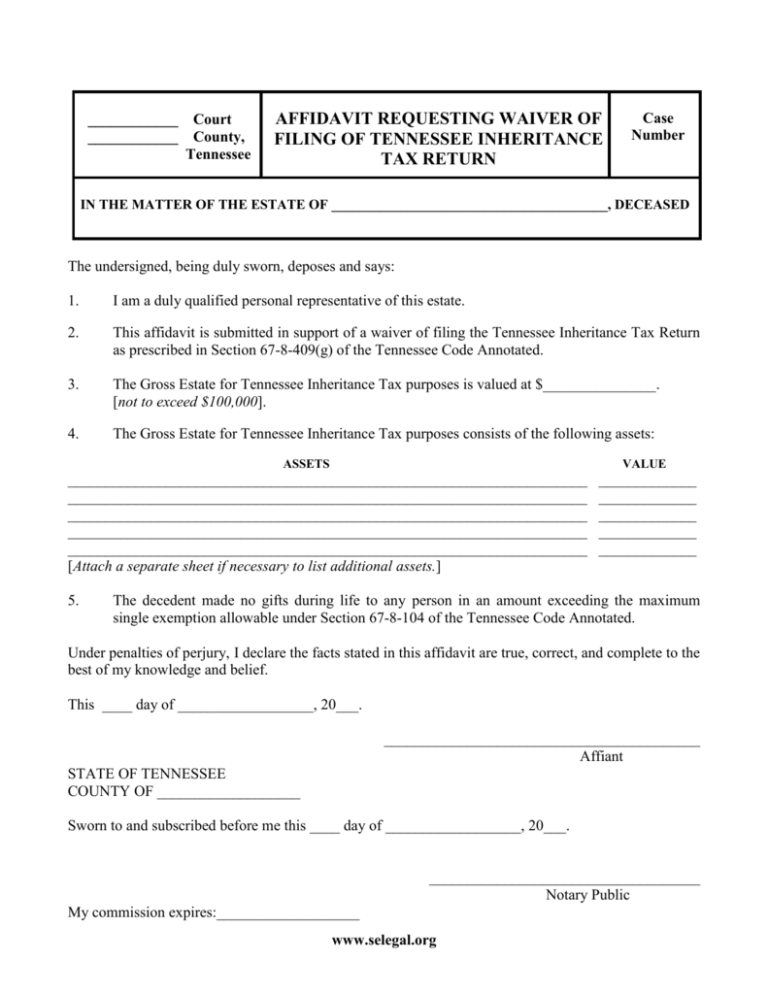

There are NO Tennessee Inheritance Tax. Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301. Tennessee residents may wish to apply for an inheritance tax waiver if the decedent died between 2006 and 2012 and left an estate which is less than the exemption allowed heirs.

For nonresidents of Tennessee an estate may. This means that if you are a resident of Tennessee or own real estate in this state you will not have to pay an. Tennessee law sets forth the.

All inheritance are exempt in the State of Tennessee. There three different ways to classify property for the sake of inheritance. A significant estate planning change takes effect on January 1 2016.

In 2015 it climbed up to 5 million. As of January 1. Hire a good estate planning attorney.

For Tennessee residents an estate may be subject to the Tennessee inheritance tax if the total gross estate exceeds 1250000. A All property real and personal shall be appraised at its full and true value at the date of the death of the. The maximum Tennessee estate tax.

Those who did have to pay saw taxes set between 55 percent and. There is no inheritance tax in Tennessee this would be tax that falls on the heirs and beneficiaries not on the estate of the person who died. Next year the Tennessee Inheritance Tax will be abolished.

The inheritance tax is due to the tennessee department of revenue nine months after the death of an individual who owes the tax. Today the Tennessee Inheritance Tax exemption for 2015 is raised to 500000000. The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is.

Those who handle your estate following your death though do have some other tax returns to take care of such. If the total Estate asset. An inheritance tax is a tax on the property you receive from the decedent.

The inheritance tax applies to money and assets after distribution to a persons heirs. The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax. The inheritance tax is levied on an estate when a person passes away.

Under tennessee law the tax kicked in if your estate all the. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have. The inheritance tax is different from the estate tax.

There is no inheritance tax in Tennessee this would be tax that falls on the heirs and beneficiaries not on the estate of the person who died. Prior to 2016 Tennessee imposed a separate inheritance tax and had an exemption from that tax that was less than the federal estate tax exemption. For the first time in 86 years Tennessee will not have.

Add a transfer on death deed to any real. Open bank accounts and designate heirs as beneficiaries of the accounts. Inheritance Laws in Tennessee Probate in Tennessee.

Tennessees estate laws govern how a persons property collectively known as the estate is to be divided upon his death. Probate is a court-supervised process that gives a family member such as a surviving spouse or. The good news is that Tennessee is not one of those six states.

Up to 25 cash back What Tennessee called an inheritance tax was really a state estate taxthat is a tax imposed only when the total value of an estate exceeds a certain value. Technically Tennessee residents dont have to pay the inheritance tax. Tennessee is an inheritance tax and estate tax-free state.

Tennessee Property Assessment Glossary

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

What You Need To Know About Tennessee Will Laws

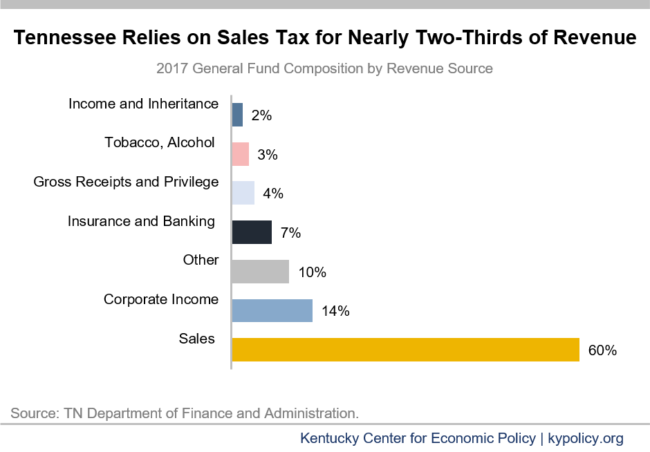

Shifting To A Tennessee Like Tax System Would Harm Kentucky Kentucky Center For Economic Policy

Living Trusts Revocable Trust Trust Words Living Trust

Tennessee Property Tax Relief Program Help4tn Blog Help4tn

State Estate And Inheritance Taxes Itep

How Do State And Local Individual Income Taxes Work Tax Policy Center

Tennessee Health Legal And End Of Life Resources Everplans

The Ultimate Guide To Tennessee Real Estate Taxes

Tennessee Taxes Do Residents Pay Income Tax H R Block

Historical Tennessee Tax Policy Information Ballotpedia

Graceful Aging Legal Services Pllc Estate Planning Attorney Legal Services Estate Planning

Tennessee Has The Most Regressive Tax System In America The Atlantic